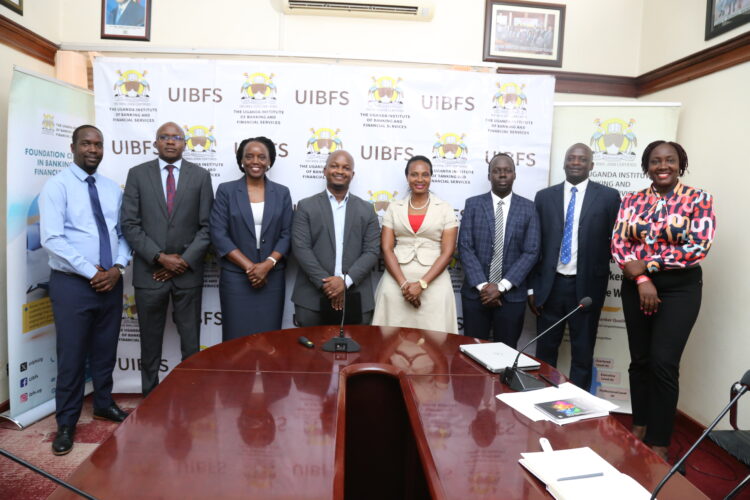

The Uganda Institute of Banking and financial services has held it’s very first data governance forum today thursday 17th October 2024 at the main offices in Kampala.

The online engagement moderated by Mr Paul Mugerwa a seasoned researcher started early morning with different discussions highlighting on the issues of data protection.

Basing on a theme “data governance and Risk Management”, the forum brought together various keynote speakers discussing regulatory requirements and how to mitigate data related risks providing an in depth understanding of data governance in an organization setting.

The first keynote speaker Mrs Milly Nalukwago Isingoma the director of statistics at the Bank of Uganda highlighted on the importance of data governance and data quality in gaining a competitive advantage.

She discussed on the essentiality of participants in the banking and financial sector to be well equipped with knowledge about data quality and governance as a tool to set them apart from other sector players in the economy and globally.

The second keynote speaker Mr Elly Beingana a manager, Management information and system automation analytics broke down the pillars for data governance implementation.

He delivered extensional knowledge on the three key stages of data governance implementation which include ” developing a data governance strategy, building a data governance team,and creating data governance policies”.

Another keynote speaker Mr Osbert Osami,Head Ict Advisory research and strategy centenary technology Services, brought into light the topic of data lineage and impact analysis in a session where he emphasized on the “data journey”.

He noted that ” it is important to understand how your data moves from the beginning to the end “.

In his conclusions, he remarked that data lineage is essential for data transparency compliance and governance.

He further called upon Banking institutions to improve decision making and regulatory compliance through implementing effective data lineage practices.

Other keynote speakers included Mrs Edna Kasozi,Mr Mabira Conrad William and Ms Solomy N Luyombo who threw more light on sensitive data governance topics such as Data protection , cyber security in the financial services industry and the role of leadership and employee engagement in creating a successful organization data governance and data quality culture.

Speaking on the same event , the CEO of UIBFS Mrs Masadde Goretti stated that the Institute’s mandate is to promote professionalism and continuous learning within the banking and finance sector something she aclaimed this forum is meant for.

“In the current data driven world , especially in an industry that manages people’s money ,data governance has become essential. The ability to handle data accurately and securely is key not only to gaining competitive advantage but also to maintaining trust and compliance in the sector.”

“This forum will equip us with strategies to navigate the regulatory requirements and mitigate data related risks.” She remarked.

The Uganda Institute of Banking and financial services established in 1990 is involved in provision, promoting and regulation of banking and finance education.

The forum is expected to be the start of many to be held in the near future highlighting on the issues of Data Protection.

Discussion about this post