Achol Tinah

In early 2025, the simmering tensions between the United States and China erupted into a full-scale trade war, marking a dramatic escalation in one of the world’s most consequential economic rivalries. Triggered by a new wave of U.S. tariffs on Chinese imports and retaliatory measures from Beijing, the dispute has sent shockwaves through global markets, disrupted supply chains, and intensified geopolitical rivalries.

The roots of this conflict stretch back to the 2010s, when the U.S. first began targeting China for what it described as unfair trade practices, intellectual property theft and state subsidies to key industries. While temporary truces were brokered under various administrations, the issues remained unresolved.

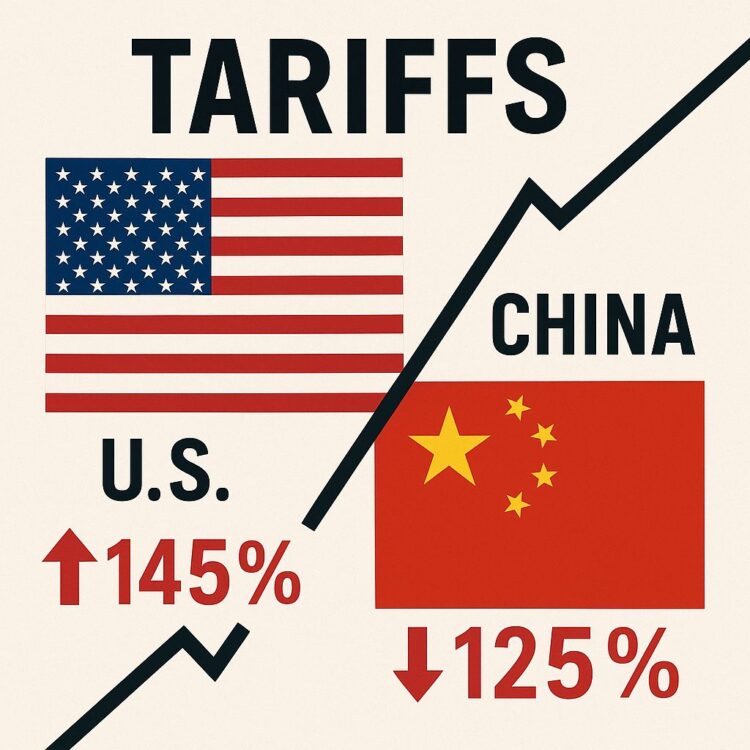

With the return of Donald Trump to the presidency in 2024 tensions reignited swiftly. Trump, continuing his “America First” agenda, accused China of currency manipulation and failing to uphold earlier trade deal promises. In March 2025, he imposed a sweeping 145% tariff on a broad range of Chinese goods far beyond previous levels.

Beijing wasted no time in retaliating. The Chinese government imposed 125% tariffs on major American exports, including soybeans, pork, electronics, and automotive components. Perhaps more strikingly, China canceled orders for over $4 billion worth of American pork and grain, a move that devastated rural U.S. economies heavily reliant on exports.

President Xi Jinping delivered a scathing rebuke, condemning what he called “unilateral bullying” and affirming that China would “not kneel to coercion.” The state-run media launched a massive propaganda campaign, portraying the trade war as a national struggle for economic dignity and sovereignty.

The ripple effects of the trade war have been dramatic:

• Global Markets Tumble: Stock markets across Asia, Europe, and the U.S. experienced volatility with tech and manufacturing sectors hit hardest.

• Supply Chains Disrupted: Multinational companies like Apple, Tesla, and Intel warned of product delays and rising costs prompting a shift toward alternative manufacturing hubs in Southeast Asia and India.

• Inflation Surge: In both countries the price of goods has soared. In the U.S., the Consumer Price Index jumped by 6.1% in April 2025 alone, the highest monthly increase in a decade.

• WTO Gridlock: Attempts by the World Trade Organization to mediate the conflict have stalled, as both nations accuse the body of bias and inefficiency.

Despite public claims by Trump of ongoing negotiations, Chinese officials have denied that any formal talks are taking place. Diplomatic ties are at a historic low, with consulates shut down in multiple cities and cultural exchange programs suspended.

Interestingly, Trump’s envoy, real estate executive Steve Witkoff, has been shuttling between Moscow and Beijing in an unofficial capacity, raising eyebrows about back-channel diplomacy.

Economists warn that if the trade war continues into late 2025, it could push the global economy into a recession. Meanwhile, smaller nations are caught in the crossfire, forced to choose sides or scramble for new economic alignments.

As of now, neither side appears willing to back down. With nationalist sentiments running high in both capitals and economic pain spreading, the world watches anxiously as the two largest economies lock horns in a conflict whose consequences may echo for decades.

Discussion about this post